What is hard money?

Hard money has been a term used to refer to money such as gold, silver or other metals/commodities as money. Soft money, on the contrary, refers to paper/fiat money.

For the purpose of this article I refer to hard money as money that is hard to create (Gold, Bitcoin) while soft money (USD, etc.) is money that is easy to create.

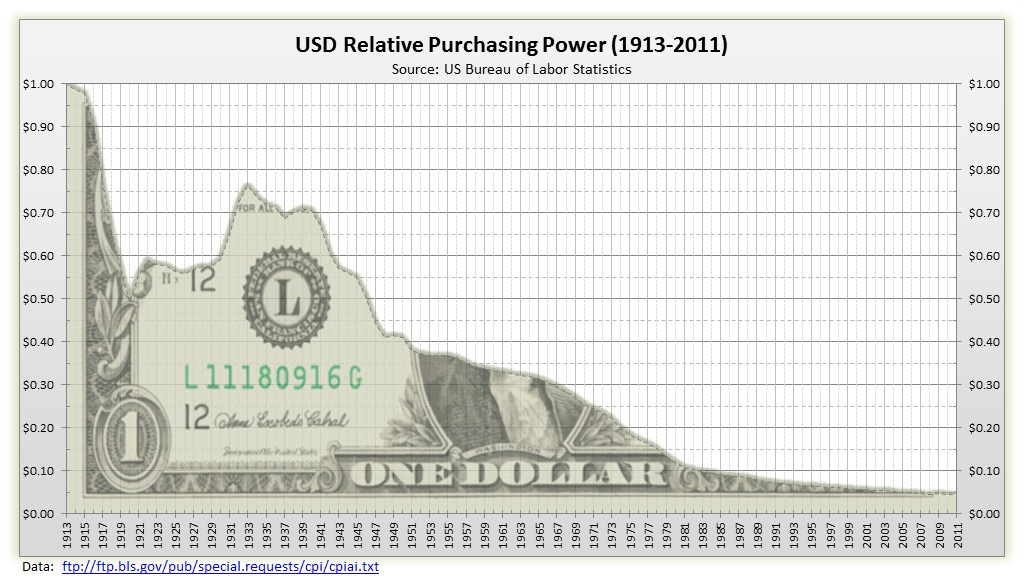

In the current monetary system, we are accustomed to prices of goods and services rising year-over-year. This overall trend is a result of monetary inflation caused by soft money. Despite the economy becoming more efficient in various domains, prices still rise.

Thought experiment

Let’s imagine we produce 1 unit of goods and the economy has 1 unit of money. Now we become more efficient and develop ways to produce more goods in less time. We now make 10 units of goods. If the total economy still consists of the 1 unit of money, then that 1 unit needs to account for a larger economy of goods, thus making the price of the goods fall to 1/10th of their previous value.

Only when we become LESS efficient or produce MORE money do we get the opposite effect. This is precisely what is going on with our soft money system. I would argue that we’re still getting more efficient, but the rate of monetary expansion is outpacing that growth. (1 good + 1 unit of money => 10 goods + 100 units of money).

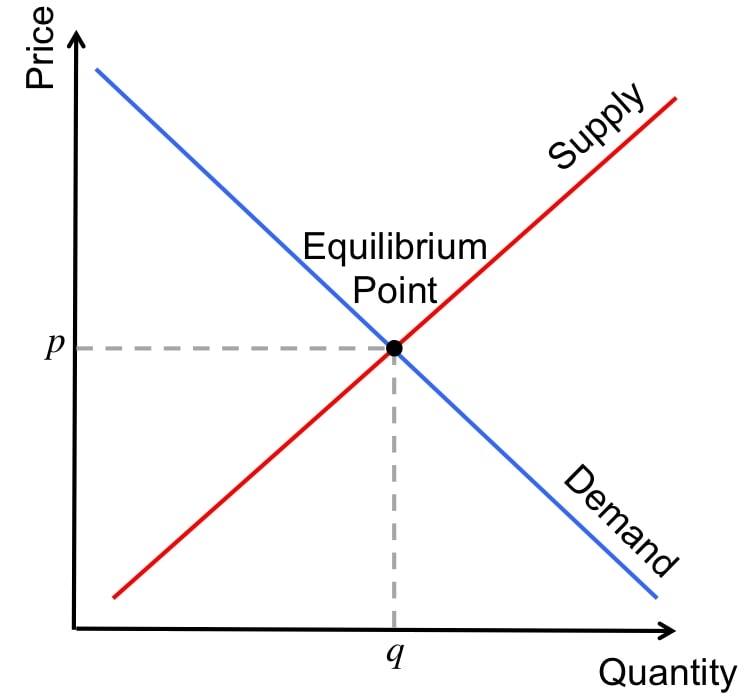

Basic law of supply and demand

The effects of soft money

This system makes savers lose out on their share of the productive labor they contributed by taking their more valuable money in the moment of saving it to become less valuable money when they choose to spend it in the future. All while benefitting people that borrow money with current (expensive) money and pay it back with the future’s cheaper money.

In my opinion, this is a root cause of the consumerist culture that we see today. People are incentivized not to hold onto money that loses value. This also negatively impacts people that want to save for retirement, forcing them to gamble in the stock market just to be able to retire with enough money to survive.

It’s hard to imagine how inflationary money can be a good thing, otherwise countries like Venezuela would be exceptionally wealthy. If we equate monetary inflation to stealing someone’s previously performed labor, it doesn’t matter how much inflation is occurring. The idea that we want to target 2-3% inflation is nonsense. Why such an arbitrary number? Why not 1%, 10%, 20%, 100%? Should we want our units of money to increase in equal with the productivity of goods in our economy?

Hard money standard

Understanding a hard money standard requires a complete shift in the way we view money and many other things we presume about how the world works. With hard money, we would see prices of goods and services decrease in value every year. This would include cars, computers, houses, and even wages. Yes, the market would try to push your wage LOWER each year. Employers currently have to bid up wages to attract quality employees YoY and with a hard money they would do the same but in a downward direction, trying to decrease the wage as little as they can to remain competitive.

This isn’t as big of a deal as it seems though because what happens is your money is now able to buy more than it used to previously. After enough years you can retire on a wage that was modest at the time but, 20 years later, is now ridiculous to even imagine someone getting paid. Similar to someone being paid $5/hour in the 80s vs now, or a $80k house then vs the $300k house today.

This same process will disincentivize people to borrow money, as it will be harder to pay off. This will prevent overconsumption of resources. Also, knowing your money can buy more in 5 years then it does today is a good reason to hold onto your savings for a future date and curb spending.

Enter Bitcoin

Bitcoin is a form of money that has a mathematically enforced cap of 21 millions coins. There will never be more of them, thus the entire economy is represented as (Everything / 21,000,000).

If you own bitcoin and the total amount of goods and services increases, then your purchasing power increases along with them. Bitcoin can bring a new paradigm of economic prosperity by allowing the deflationary effects of technology to reduce prices and allow us ever more leisure time and increasing wealth over time.

I will eventually follow this idea up with other posts in the future.